Attention: Changes Going into Effect July 1, 2023

Per RMA bulletins Product Management Bulletin: PM-23-022*, revisions were made to the Livestock Gross Margin (LGM), Livestock Risk Protection (LRP) and Dairy Revenue Protection (DRP) plans of insurance for 2024 and succeeding Crop Years (CY).

LGM Changes:

- Allowed producers to sign application for coverage ahead of sales period;

- For LGM Cattle & Swine, modified the end of the sales period to 8:25 AM Central Time.

LGM provides protection against the loss of gross or finishing margins caused by a drop in animal prices or increase in feed prices. However, LGM does not insure against death loss or any other loss or damage to the producer’s animals.

The policy covers the difference between the gross margin guarantee and the actual gross margin at the end of the insurance period. Futures prices are used to determine the expected gross margin and the actual gross margin. The price the producer receives at the local market is not used in these calculations.

Livestock Gross Margin = Live Cattle Price – Cost of Corn – Cost of Feeder Calf

New for 2023

- Now available in all 50 states.

- Allows an insured to have both an LGM and LRP policy; however, an insured may not insure the same class of livestock with the same end month or have the same insured livestock under multiple policies.

Provides protection against loss of gross margin (market value of cattle minus feeder cattle and feed costs) on cattle. LGM covers a decline in cattle prices and/or an increase in feed costs and/or an increase in feeder cattle prices.

Provides protection against the loss of gross margin (market value of milk minus feed costs) on the milk produced from dairy cows.

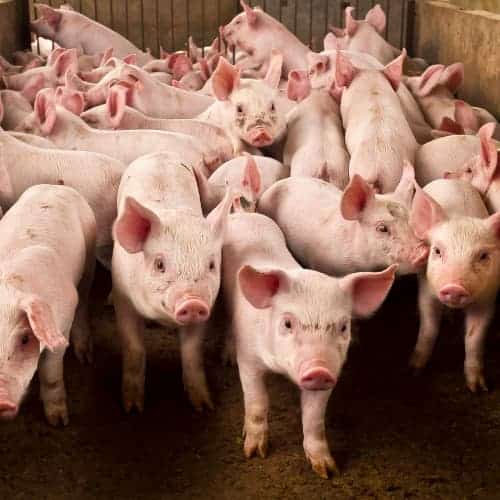

Provides protection of the gross margin between the value of insured hogs and the cost of corn and soybean meal. LGM covers a decline in hog prices and/or an increase in feed costs.

LGM insurance protects against a decrease in live cattle and swine prices and an increase in feeder calf and feed costs in one bundle.

Protect against loss of gross margin with LGM insurance.